Highlights |IAS Current Affairs 06-07-2019

Current Affairs and News (06-07-2019)- The following article contains all the updated events and new for IAS Preparation. Our daily IAS Current Affairs and News cover the most important topics to give precise information to the reader and IAS Aspirants.

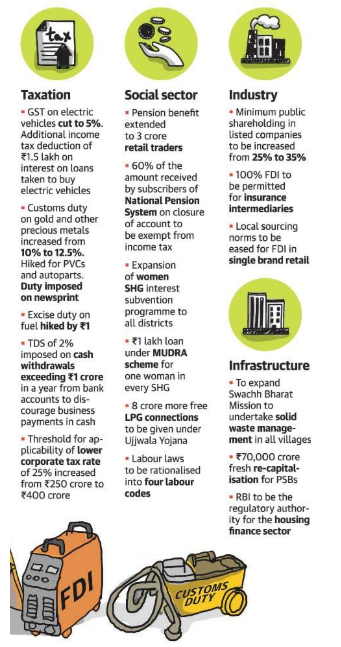

- Step by step Nirmala’s maiden Budget is all about incremental measures

- Budget proposes higher income tax on rich

- Aadhaar can be interchanged with PAN for filing tax returns

- Government eases angel tax norms

- Fiscal deficit target revised downwards to 3.3%

- Slew of steps to boost digital payments

- RBI can supersede NBFC board

- Big boost for disaster management

- Private funds needed for Swachh Bharat

- Reward top taxpayers, shame defaulters

- Expanding India’s share in global space economy

Importance of Current Affairs in IAS Coaching

Watch Video – IAS Coaching Current Affairs 06-07-2019

Video Source – Shankar IAS Academy

find top institutes for IAS coaching

IAS Coaching Current Affairs 06-07-2019 are followed in the part below:

IAS Current Affairs and News Analysis (06-07-2019)

Step by step Nirmala’s maiden Budget is all about incremental measures

Part of Prelims and mains GS III Indian Economy

In news

Budget proposes higher income tax on rich

Part of Prelims and mains GS III Indian Economy

In news

- The Union Budget has proposed to expand extra charge on people having assessable pay from ₹2 crores to ₹5 crores and ₹5 crore or more with the goal that compelling expense rates for these two classifications will increment by around 3% and 7% individually.

- As indicated by the administration, this expansion in the extra charge is required to acquire the legislature an extra ₹12,000 crore a year.

- The immediate expense assortments are presently developing in twofold digits consistently.

- Organizations with a turnover of up to ₹400 crore a year would now need to make good on government obligation at 25%. This turnover limit was before ₹250 crore a year. As far as possible will presently cover 99.3% of organizations.

- This is an inviting move towards crossing over any barrier of corporate expense with the ASEAN nations.

- Various measures were declared, for example, electronic face-less appraisals, to improve straightforwardness in annual charge evaluation procedure and furthermore to facilitate the arrival documenting the process for charge filers.

- To begin with, such re-evaluations are to be done in cases requiring confirmation of certain predetermined exchanges or inconsistencies.

Aadhaar can be interchanged with PAN for filing tax returns

Part of Prelims and mains GS III Indian Economy

In news

- In excess of 120 crore Indians presently have Aadhaar. Though, as indicated by information with the Central Board of Direct Taxes (CBDT), 42 crore PAN cards have been given, of which just 23 crore have been connected with Aadhaar.

- The Union Budget 2019-20 has proposed to make Aadhaar compatible with PAN, in this way enabling individuals without PAN to document annual expense forms utilizing just their Aadhaar.

- The Income Tax Department will dispense PAN to such people based on Aadhaar in the wake of acquiring statistic information from the Unique Identification Authority of India (UIDAI).

- It has been clarified that the expectation isn’t to supplant PAN with Aadhaar as the essential personality confirmation with regards to annual expense.

- It has been proposed distributing Aadhaar to non-occupant Indians, landing in India, on a sped-up premise.

- Up until this point, non-occupant Indians with an Indian international ID needed to sit tight for 180 days after their appearance in India before they can apply for Aadhaar. The Budget proposed to expel this holding uptime.

Government eases angel tax norms

Part of Prelims and mains GS III Indian Economy

In news

- To energize new companies in the nation, a progression of measures has been declared for the division, including facilitating the much-discussed point charge.

- Presently, the new companies who document imperative revelations won’t be dependent upon any sort of examination in regard to valuations of offer premiums.

- Also, the issue of setting up the character of the financial specialist and wellspring of his finances will be settled by setting up a system of e-confirmation.

Angel Tax

- Blessed messenger charge is material to unlisted organizations that have raised capital through clearance of offers at an incentive over their honest worth.

- This overabundance capital is treated as salary and burdened appropriately. This expense transcendently influences new businesses and the blessed messenger speculations they draw in.

Channel for start-ups

- The Finance Minister has likewise proposed to begin a TV program inside the DD bundle of channels only for new companies.

- The proposed program on new businesses will fill in as a stage for advancing new businesses, talking about issues influencing their development, matchmaking with financial speculators and for subsidizing and expense arranging, and so on.

- The channel will be planned and executed by new companies themselves.

Fiscal deficit target revised downwards to 3.3%

Part of Prelims and mains GS III Indian Economy

In news

- The legislature is assessing a monetary deficiency of 3.3% of GDP in money related year 2019-20, lower than the 3.4% evaluated before in the meantime Budget exhibited in February.

- The fundamental purpose behind this is an expansion on the income side, while use is being controlled.

- To accomplish this goal(of 3.3%), it is depending on one-off disinvestment pay, just as higher expenses on the rich, and expanded extract obligations on oil, diesel, valuable metals, and tobacco items.

- Additionally, the legislature had planned a profit from the Reserve Bank of India adding up to about ₹90,000 crores.

- The administration has cut the assignments for a few significant plans. Generally huge of these is the ₹4,334 crore cut for the Swachh Bharat plot.

Slew of steps to boost digital payments

Part of Prelims and mains GS III Indian Economy

In news

- To push advanced installments, numerous measures have been declared including demanding 2% charge deducted at source on money withdrawals surpassing ₹1 crore in a year from a ledger.

- The business foundations with a yearly turnover of more than ₹50 crore will offer minimal effort computerized methods of installment, for example, BHIM UPI, UPI-QR Code, Aadhaar Pay, certain Debit cards, NEFT and RTGS, to their clients and no charges or Merchant Discount Rate will be forced on clients just as dealers.

- These measures would help make a strong installments framework in the nation. Be that as it may, there is a requirement for adequate Internet infiltration and information reach to accomplish the goals.

RBI can supersede NBFC board

Part of Prelims and mains GS III Indian Economy

In news

- Non-banking account organizations that are confronting an emergency of certainty saw a large number of measures from the Budget to reestablish speculator certainty.

- The Reserve Bank of India likewise stepped in as it reported extra liquidity backing to the area through banks to the tune of ₹1.34 lakh crore.

- The legislature has chosen to give more powers to the Central bank to control the non-banking account organizations.

- As per the Finance Bill, if the RBI is fulfilled that in ‘the general population intrigue’ or to avoid the issues of an NBFC being led in a way impeding to the enthusiasm of the contributors or banks, the board can be supplanted for a most extreme five years and ahead can be designated.

- The RBI will likewise manage lodging account organizations that are under the domain of the National Housing Bank.

- The financial backing additionally suggested that outside institutional speculators and remote portfolio financial specialists will be permitted to put resources into obligation protections by shadow banks, which help NBFCs to raise more assets.

- The monetary allowance additionally gave some assessment motivations to the NBFCs by treating them with keeping pace with banks.

Big boost for disaster management

Part of Prelims and mains GS III Security and disaster management

In news

- Budgetary designation for Home Ministry up by 5%, extraordinary center around debacle the executives, cybercrime foundation and political dissidents’ benefits.

- A measure of ₹100 crore has been allotted for the Indian Cyber Crime Coordination Center, contrasted with ₹6 crores in the last monetary.

- Complete assets for fiasco the board has been reserved at ₹577.93 crores, a hop from ₹284.82 crores a year ago. Of this, the part for National Cyclone Risk Mitigation has been expanded from ₹3.03 crore to ₹296.19 crore.

Private funds needed for Swachh Bharat

Part of Prelims and mains GS III Indian Economy, GS II Governance

In news

- 99.2% of country India is currently open crap free and in this way, the following objective of the Swachh Bharat ought to be to have 100% protected and logical transfer of strong and fluid waste.

- The protected and logical transfer of strong and fluid waste would incorporate improvement in working conditions for sanitation laborers and manual foragers, sewer development and water accessibility, treatment of modern discharge, channel bio-remediation, waterway surface cleaning, aside from different measures.

- The government should likewise designate satisfactory assets to embrace such measures and separated from this, private organizations, for example, through corporate social obligation, swarm subsidizing lined up with nearby government financing, among different measures can be attempted to back logical transfer of waste.

Reward top taxpayers, shame defaulters

Part of Prelims and mains GS III Indian Economy

In news

- The Economic study features the use of conduct financial aspects to acquire a social change among individuals India.

- The financial overview features the Swachh Bharat Mission, Beti Bachao Beti Padhao and other government plans and arrangements that have been fruitful in changing the social mentality inside India.

- Also, the financial overview plans to guarantee a social change or an adjustment in the outlook of individuals in India to accomplish three principal objectives: Gender uniformity, Healthy India and expansion in charge consistence.

- Utilizing conduct financial matters, Economic Survey proposes for social change:

- From BBBP ( Beti Bachao Beti Padhao) to BADLAV (Beti Aapki Dhan Lakshmi Aur Vijay Lakshmi);

- From SB (Swachh Bharat) to SB (Sundar Bharat);

- From “Leave it” for the LPG Subsidy to “Consider about the Subsidy”; and

- From tax avoidance to tax consistence.

- A model in Economic Survey is to give administrations to high charge paying people that respects them, for example, assisted boarding benefits at air terminals, fast track benefits on streets and toll stalls, unique ‘strategic’ type paths at movement counters, and so forth.

- It included that the most noteworthy citizens over 10 years could be perceived by naming significant structures, landmarks, streets, trains, activities, schools and colleges, emergency clinics and air terminals in their name.

- Aside from this, assessment dodgers can be openly disgraced to bump them and make other expenses dodgers frightful of tax avoidance.

(MAINS FOCUS)

NATIONAL

TOPIC: General studies 3

- Awareness in the fields of IT, Space

Expanding India’s share in global space economy

Introduction

From an unassuming start during the 1960s, India’s space program has developed relentlessly, accomplishing huge achievements. These incorporate the manufacture of satellites, space-dispatch vehicles, and scope of related capacities.

ISRO’s thrust areas

Since its foundation in 1969, ISRO has been guided by a lot of crucial vision explanations covering both the cultural goals and the push regions.

First Thrust Area: Satellite communication

- It is to address the national requirements for media transmission, broadcasting, and broadband foundation.

- INSAT and GSAT are the spines of India’s satellite correspondence.

- Bit by bit, greater satellites have been manufactured conveying a bigger cluster of transponders to give administrations connected to regions like media transmission, telemedicine, TV, broadband, radio, catastrophe the board and look and salvage administrations.

Second Thrust Area: Earth Observation

- It is to utilize space-based symbolism for a large number of national requests, going from climate gauging, fiasco the board, and national asset mapping and arranging.

- These assets spread horticulture and watershed, land asset, and ranger service to the executives.

- With higher goals and exact situating, Geographical Information Systems’ applications today spread all parts of rustic and urban improvement and arranging.

- Starting with the Indian Remote Sensing (IRS) arrangement during the 1980s, today the RISAT, Cartosat, and Resources at arrangement give wide-field and multi-unearthly high-goals information for land, sea, and environmental perceptions.

Third Thrust Area: satellite-aided navigation

- The GPS-helped GEO enlarged route (GAGAN) is a joint undertaking among ISRO and the Airports Authority of India.

- It expanded the GPS inclusion of the locale, improving the exactness and honesty, essentially for common avionics applications and better air traffic the board over Indian airspace.

- This was caught up with the Indian Regional Navigation Satellite System (IRNSS), a framework dependent on seven satellites in geostationary and geosynchronous circles.

Fourth Thrust Area: space science and exploration missions

- It incorporates the Chandrayaan and the Mangalyaan missions, with a kept an eye on space strategic, anticipated its first experimental drill in 2021.

- These missions are for innovation showing as well as for growing the wildernesses of information in space sciences.

Launch Vehicle Technology

- Starting with the Satellite Launch Vehicle (SLV) and the Augmented Satellite Launch Vehicle (ASLV), ISRO has created and refined the Polar Satellite Launch Vehicle (PSLV) as its workhorse for putting satellites in low earth and sun-synchronous circles.

- The Geosynchronous Satellite Launch Vehicle (GSLV) program is as yet creating with its MkIII variation, having attempted three missions, and is fit for conveying a 3.5 MT payload into a geostationary circle.

ISRO and Industry

- Throughout the years, ISRO assembled a solid relationship with the business, especially with Public Sector Undertakings (PSUs) like Hindustan Aeronautics Limited and Bharat Electronics Limited, and so forth and enormous private area substances like Larsen and Toubro, Godrej and Walchandnagar Industries.

- Notwithstanding, the vast majority of the private area players are Tier-2/Tier-3 merchants, giving segments and administrations. The Assembly, Integration, and Testing (AIT) job is limited to ISRO.

- ISRO set up Antrix, a private constrained organization, in 1992 as its business arm to showcase its items and administrations and interface with the private division in the exchange of innovation associations.

- Today, the estimation of the worldwide space industry is assessed to be $350 billion and is probably going to surpass $550 billion by 2025.

- Regardless of ISRO’s amazing capacities, India’s offer is evaluated at $7 billion (only 2% of the worldwide market).

New Space and New developments

- Improvements in Artificial Intelligence (AI) and enormous information examination has prompted the rise of ‘New Space’ — a problematic unique dependent on utilizing start to finish effectiveness ideas.

- A parallel is the means by which the autonomous application engineers, offered access to the Android and Apple stages, reformed cell phone utilization.

- The New Space new companies observe a collaboration with the government’s leader programs like Digital India, Start-Up India, Skill India and plans like Smart Cities Mission.

- They need an empowering environment, a culture of quickening agents, hatcheries, Venture Capitalists and guides.

- Another transformation in progress is the little satellite upheaval. Universally, 17,000 little satellites are required to be propelled among now and 2030.

- ISRO is building up a little satellite dispatch vehicle (SSLV) expected to be prepared in 2019.

- Service of Defense currently setting up a Defense Space Agency and a Defense Space Research Organization, ISRO ought to effectively grasp a solely regular citizen character.

Conclusion

Another Space law for India should target encouraging developing a lot of worldwide space economy to 10% inside 10 years which requires another sort of association between ISRO, the built-up private part, and the New Space business people.

Connecting the dots:

ISRO has finished 50 years of its voyage in India’s space research and investigations. Clarify quickly its accomplishments. Propose a few measures for its way ahead.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in the comment section)

Note: Featured Comments and comments Up-voted by Wahtaftercollege are the “correct answers”.

Q.1) Consider the following statements regarding The Union Budget 2019-20

- It has proposed to make Aadhaar interchangeable with PAN, thereby allowing people without PAN to file income tax returns using only their Aadhaar.

- It has proposed to replace PAN with Aadhaar as the primary identity proof when it comes to income tax.

Select the correct statements

- Only 1

- Only 2

- Both 1 and 2

- Neither 1 nor 2

Q.2) Consider the following statements about the total fertility rate in India,

- The government is estimating a fiscal deficit of 3.3% of GDP in the financial year 2019-20.

- For the year 2018-19, the fiscal deficit target was 3.4%

Select the correct statements

- Only 1

- Only 2

- Both 1 and 2

- Neither 1 nor 2

Q.3) Consider the following statements

- India’s satellite launching vehicle GSLV MK III is in the developmental stage.

- GAGAN and NavIC are the satellite systems related to navigation systems in India.

Select the correct statements

- Only 1

- Only 2

- Both 1 and 2

- Neither 1 nor 2

Importance of Current Affairs in IAS Coaching

Check out more IAS Coaching Current Affairs

Also, Check Out the All the Details about the IAS Exam